Prioritize Your Savings: A Guide for Getting Started

Whether it’s saving for retirement, paying down debt, buying a home, or building liquidity, deciding where your dollars should go first can be tough — especially as a young dentist, when money is tight.

At the beginning of a budding career, nothing seems further away than retirement. Focusing on saving for an event 40 years in the future can seem counterintuitive when today’s needs and desires seem much more urgent. Short-term goals, such as paying off a student loan or making a down payment on a home, can feel rewarding because they offer quick wins, while saving for retirement might not deliver that same immediate satisfaction.

But when motivation feels low, it helps to think about the future value of your money: The dollar you save today could grow to be worth five times as much down the road. That’s a powerful reason to keep going.

Although opening that first investment retirement account is the hardest, it’s essential to start early. Compounding interest is the biggest asset you have on your side. Let’s look at an example:

If you contribute $6,000 to an IRA annually ($500 per month) from age 25 to 65, this account could grow to almost $1.3 million, assuming a 7% growth rate. Of that $1.3 million, you will have contributed $246,000 ($6,000 a year for 40 years), while more than $1 million will have been generated by returns. The earlier you start saving, the faster your money can take advantage of this compounding.

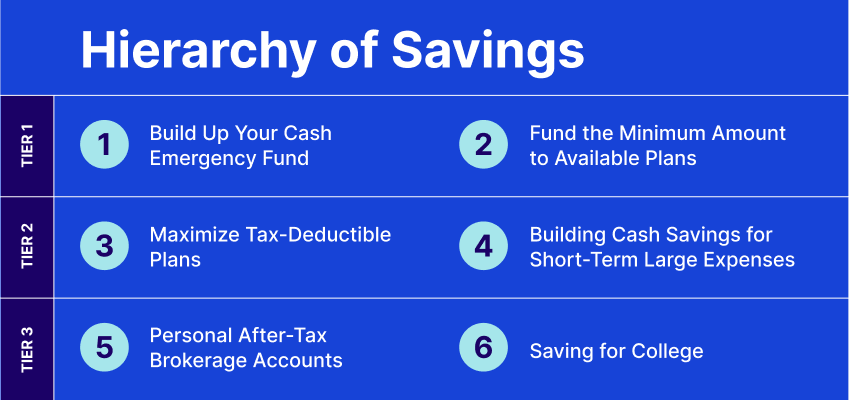

The 6 Vital Categories To Save For

So, where do you start when there are limited funds? When every goal pulls you in different directions, consider saving in six categories. Start with the first two as Stage 1 and roll into the other categories.

1: Build Up Your Cash Emergency Fund

Emergencies and volatility can happen, and you need to be prepared. To give yourself peace of mind, aim to set aside enough cash to cover three to six months of basic living expenses in an easily accessible checking or savings account.

If it seems overwhelming to save that much, build out this balance over one or two years. Find out your living expenses for three to six months, then divide that by 12 or 24. For example, if your basic living expenses are $4,000 per month ($12,000 for three months), save $500 per month to reach your goal in two years.

2. Fund the Minimum Amount To Earn an Employer Match

If your employer offers a 401(k) matching plan, then not saving at least that amount would throw away free money. It’s OK not to save the maximum allowed at this point, but with time on your side, you need to start somewhere. Taking advantage of employer match 401(k) and HSA funds today will significantly impact tomorrow.

An investment hierarchy is simply a recommended order of investment categories. For example, you should generally not invest in after-tax brokerage accounts before you have maximized the tax-advantaged plans available to you, and you shouldn’t aim to max out your retirement accounts before you have an emergency fund in place.

3. Maximize Tax-Deductible Plans

Once you’re comfortable with Steps 1 and 2, it’s time to start working toward saving even more by maximizing your employer’s 401(k). Consider increasing your contribution by a few percentage points each year or when you receive a raise. In 2025, the limit is $23,500 for those younger than 50 and $31,000 for those older than 50 by the end of the calendar year.

If your employer doesn’t offer one, research other options, such as a simplified employee pension plan, an individual retirement account, and health savings accounts.

4. Build Cash Savings for Short-Term Large Expenses

These unique savings accounts work toward significant expenses you know are coming in the next five years — a down payment on a new home, a new car, a wedding, or vacations. These accounts should be kept separate from the emergency fund, because these are expected expenses.

5. Invest in a Personal After-Tax Brokerage Account

Only after you’ve maximized tax-advantaged vehicles such as a 401(k) or an IRA should you start investing in a personal brokerage account to build wealth.

6. Save for College

Once children come, it’s natural to start wanting to save for their college education. Although it’s beneficial to start as early as you can, saving for a child’s college should not come at the expense of your own retirement. Students have options, including federal or private loans and scholarships, but there’s no replacement for retirement funds.

What About Debt?

Where do debt payments like student loans fit in? Most financial experts agree that while retirement is a long-term goal, paying off debt should be considered a short-term goal. Obviously, minimum payments must be made against student loan debt. If it’s important to you to make additional payments, start by using the dollars left over after Steps 1 and 2.

Quick Tip: Automate Your Savings

Create and name different savings accounts for different purposes. Within your banking portal, create different savings accounts with unique names to remind you of what goal you’re working toward. Naming each one after the goal — a future house, your next travel destination, student loans, or an emergency savings fund — makes the progress toward each one seem more real.

With each account separate, it’s even easier to set up a recurring transfer of a set monthly dollar amount toward each account’s goals. Automating your monthly savings is a foolproof way to make progress, and with today’s advanced banking applications, it can easily be set up in minutes. You’ll naturally adjust your spending by keeping these dollars out of your checking account. With this set-it-and-forget-it mindset, you’ll be surprised how much you can save in a few years.

Just Get Started!

Once you understand your income and essential living expenses, this savings hierarchy can help you confidently direct your remaining dollars toward the goals that matter most to you. Start at the top and start making progress against your short- and long-term goals. Have a unique situation and need additional guidance? A member of the Cain Watters & Associates team would be happy to help.

Cain Watters is a registered investment advisor. Cain Watters only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. Request Form ADV Part 2A for a complete description of Cain Watters investment advisory services. Diversification does not ensure a profit and may not protect against loss in declining markets. Past performance is not an indicator of future results.

FOUNDATIONS MEMBERSHIP

New Dentist?

This Program Is Just for You!

Spear’s Foundations membership is specifically for dentists in their first 0–5 years of practice. For less than you charge for one crown, get a full year of training that applies to your daily work, including guidance from trusted faculty and support from a community of peers — all for only $599 a year.

By: Sarah Oliver

Date: September 9, 2025

Featured Digest articles

Insights and advice from Spear Faculty and industry experts