Prioritize Your Savings: A Guide for Getting Started

As a young dentist when money is tight, deciding where your dollars should go first can be tough. Take this CPA's advice about how to plan for the future...

Sarah Oliver | 1 month ago ›Integrating Your Lab Into Your Daily Workflow

Thinking of your dental lab as a member of your practice team can help minimize remakes and reschedules while maximizing practice efficiency and profitability.

Edward Roman | 1 month ago ›If you're not paying attention to your dental practice's financial statistics — and making changes based on what you're seeing — you'll never...

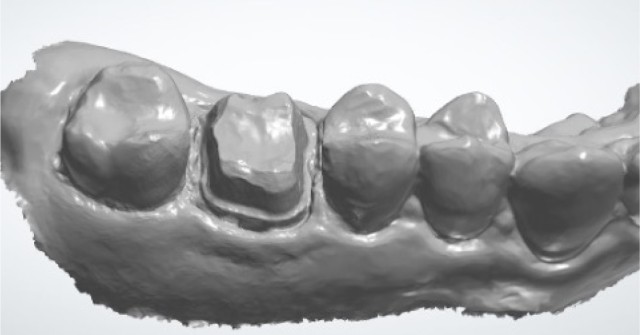

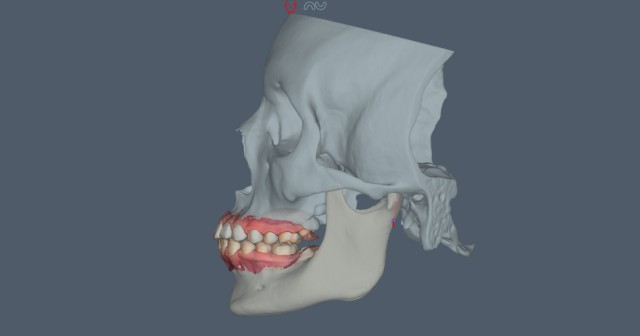

Amy Morgan | 2 months ago ›Mandibular Slides and Occlusal Management

Nearly 90% of patients aren't functioning in central relation, and removing a molar can destabilize their habitual occlusion and reveal a deeper,...

Julie Kwon | 2 months ago ›The Reference Denture Technique: An Interdisciplinary Case Study

Digital technology makes it easier to fabricate replacement dentures that require fewer adjustments but still excel at fit, function, and esthetics.

Effie Habsha | 3 months ago ›Economic Fears: How To Flourish and Prosper in Uncertain Times

Discover four strategic ways dental practice owners can boost production, improve patient retention, and drive growth—even during periods of financial stress.

Amy Morgan | 3 months ago ›How To Know If Selling to a DSO Is Right for You

Selling to a DSO is about more than just dollars. Here's how to determine if your practice is a good fit, professionally and personally.

Christy Ratcliff | 4 months ago ›Diagnosing TMD: Similarities Between Spear’s Occlusal Exam and the DC/TMD

The occlusal examination dentists learn as part of their Spear Education journey gathers the same information that's required for the diagnostic exam...

Curt Ringhofer | 4 months ago ›Treating TMD: Similarities Between Spear’s Occlusal Exam and the DC/TMD

The occlusal examination dentists learn as part of their Spear Education journey gathers the same information that's required for the diagnostic exam...

Curt Ringhofer | 4 months ago ›How Digital Technology Ignited My Love of Doing Full Dentures

An intraoral scanner and your dental lab's design and milling software make the process remarkably quick, with less chance for error.

John Carson | 4 months ago ›Ending a Dental Partnership: Learn From These Firsthand Lessons

Dental partnerships require constant effort, open communication, and a willingness to adapt. If yours isn't working, this advice can help you end it with...

Ricardo Mitrani | 5 months ago ›The ‘Wizardry’ of Light-Curing Adhesive Resin

Proper curing of adhesive resin requires deftness, knowledge, and an effective wand. In this article, Spear Resident Faculty member Dr. Jeffrey Bonk explains...

Jeffrey Bonk | 5 months ago ›